In North and South Carolina, Duke Energy’s Path to Net Zero Underpins Strong Solar Outlook

Tom Kline, 25 September 2020North Carolina is second only behind California in total solar capacity in the United States1 so it is no surprise that twenty-eight of US Solar Fund’s (USF) plants are located here but recent news makes the outlook for solar in the region look brighter still.

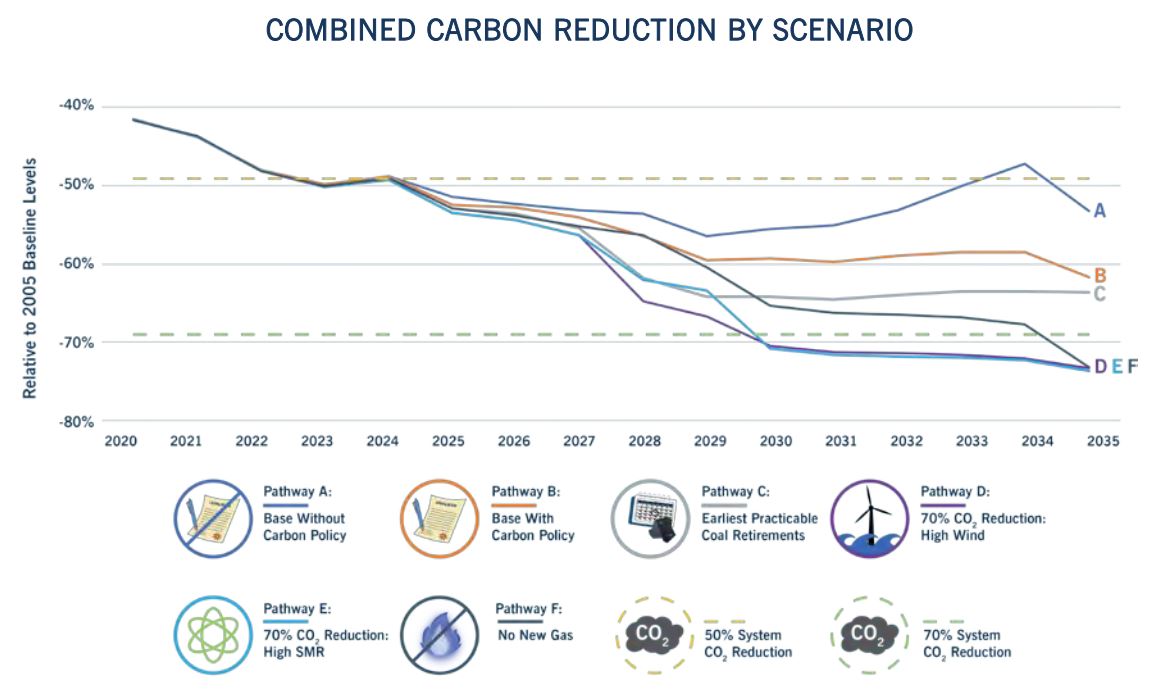

Duke Energy, the largest generator and provider of electricity in North Carolina and South Carolina and the offtaker of USF North Carolina plants, is committed to halving emissions by 2030 and achieving net zero emissions by 20502. The energy group recently released a plan setting out six scenarios by which it could achieve these goals. This commitment and scenarios are set against an outlook of increasing energy demand, despite increasing energy efficiency savings and the reduction of supply due to the retirement of large-scale coal plants. Such a commitment from one of the largest providers of energy in the US is encouraging and underpins increasing demand for solar and higher electricity prices. This is good news for both existing and new renewables plants in the Carolinas.

Duke Energy operates utilities in six states and is one of the United States’ largest providers of energy with over 7 million customers. In North and South Carolina, the business operates Duke Energy Carolinas (DEC) and Duke Energy Progress (DEP), vertically integrated utilities serving a combined 3.2 million residential, commercial and industrial customers. Duke Energy, through these subsidiaries, is the contracted offtaker for eight of New Energy Solar’s plants, all located in North Carolina.

On 1 September this year Duke Energy lodged its integrated resource plan (IRP) for 2020 which details six scenarios by which DEP and DEC could reach Duke Energy’s stated goals of halving emissions by 2030 and achieving net-zero carbon by 20503.

The six scenarios vary depending on energy policy, the introduction of a price for carbon or not, and the rate of maturation of new, clean technologies. The six possible portfolios of generating resources contemplated in the six scenarios explore, over the 15-year planning horizon, the earliest practicable paths for coal retirement, acceleration of renewable technologies, integration of battery and pumped hydro storage, expanded energy efficiency and demand response programs and rates of deployment of new technology, primarily battery storage and small modular nuclear reactors.

Despite the effectiveness of Duke Energy’s existing demand management and progress generally in energy efficiency, the IRP assumes increasing electricity demand growth of 0.5% per annum over the next 15 years. This increase is based on an increase in customers of 560,000 in the Carolinas region. This projected population and household growth is above the national average and is anticipated to result in 1,650 MW of additional winter peak demand and cumulative annual energy consumption growth of 7,200 GWh between 2021 and 2035. The increasing demand profile is also despite the continued expansion of energy efficiency and demand reduction programs. Added to the forecast growth in demand, Duke Energy is planning to retire some of its less efficient generation resources over the course of the 15-year planning horizon. After accounting for the required reserve margin, Duke Energy expects to bring approximately 4,600 MW of new resources into service in North and South Carolina over the next 15 years.

To meet its near-term target of halving emissions by 2030, Duke Energy committed in 2019 to double its 8 GW of renewable generation across all its operations by 20254 and under the two base cases in the IRP, DEP and DEC will retire all of their roughly 7 GW of exclusively coal generation units by 2035. Of the six scenarios put forward in the IRP, two are aimed at meeting the 2030 target and four go beyond the near-term target.

Source: Duke Energy Carolinas Integrated Resource Plan 2020 Biennial Report page 8 of 405

"In terms of solar, the IRP shows that the use of solar by DEP and DEC is expected to more than double to 8,650 MW by 2035, even under the base case “without carbon policy” scenario. Under the “with carbon policy” base case this rises to 12.3 GW and up to 16.4 GW under the most aggressive scenario."

In terms of solar, the IRP shows that the use of solar by DEP and DEC is expected to more than double to 8,650 MW by 2035, even under the base case “without carbon policy” scenario. Under the “with carbon policy” base case this rises to 12.3 GW and up to 16.4 GW under the most aggressive scenario.

Interestingly, the “without carbon policy” and “with carbon policy” base case scenarios are required by regulators in the Carolinas system. While there is no certainty as to how carbon policy might be implemented, the IRP second base case (with carbon policy) assumes a cost adder on carbon emissions in resource selection as well as daily operations, effectively a “shadow price” on CO2 emissions. The “shadow price” is a generic proxy that could represent the effects of a carbon tax, price of emissions allowances, or a price signal needed to meet a given clean energy standard. The assumed policy only reflects the cost of resources to meet carbon reduction targets and not the “shadow price” itself which would represent an additional cost to consumers if carbon policy took the form of a carbon tax.

The alternative pathways considered include the incorporation of emergent carbon free technologies such as battery storage and small nuclear reactors with a view to achieving a 70% reduction in carbon emissions by 2030. The IRP also includes consideration of a “no new gas” case. These pathways are more costly given the greater necessity for upgraded transmission and distribution infrastructure and highly dependent on significant advances in technology given that the levels of battery storage required, between 1 GW and 7.4 GW depending on the renewables adoption rate, would be up to approximately six times the total amount of battery storage currently deployed in the United States. Similarly, new technology typically presents a number of challenges when being deployed at scale for the first time, which would be the case for small nuclear reactors as they are not currently in commercial use. These scenarios are also likely to require more supportive state and federal legislation.

Duke Energy’s existing commitment to carbon-free generation resources such as nuclear, hydro-electric and solar, together with its provision of energy efficiency and demand-side management programs, means that together, DEC and DEP already serve more than half of the energy needs of their customers with carbon free resources. Together, they operate six nuclear plants, 26 hydro-electric facilities and own or purchase 4,000 MW of solar generation from 1,000 sites throughout the Carolinas (including USF’s sites).

The IRP also costs each scenario, including in terms of impact on individual consumers, with one of the most significant cost factors being the required investment in new transmission. Investment in transmission varies from US$900 million in the least cost, least renewables scenario to nearly ten-times that at US$8.9 billion in the most renewables ambitious scenario. These costs will ultimately be passed onto consumers in the form of higher electricity prices. Higher electricity prices in the future will benefit USF when it looks to recontract its energy post the current PPAs.

With respect to the retirement of coal, both base cases would see units that operate exclusively on coal, as opposed to dual coal and gas units, retired by 2030. DEP would retire all 3,200 MW of coal capacity by 2030 and DEC would retire approximately 3,800 MW of coal capacity by 2035. Dual coal and gas units would continue to operate primarily on gas to meet peak demand, with this form of generation making up approximately less than 5% of the energy served by the two utilities combined by 2035.

Criticism of the IRP from environmental groups5 centres on the timetable for the retirement of Duke Energy’s coal-based generation, in the base case “with carbon policy” the units are progressively retired from 2022 to 2049, and the significant reliance in most of the scenarios on an increased use of gas. The groups argue that the rapidly decreasing cost of renewables requires utilities to be more ambitious in the incorporation of renewables in their portfolios. Criticism has also come from Deloitte as to the reliance on as-yet-uneconomical technologies6.

While Duke Energy’s IRP for DEC and DEP may not meet the expectations of all commentators, this 2020 iteration has evolved significantly from 2019 and can be expected to continue to evolve given the rapidly changing technology and the cost improvements as renewable energy is more widely deployed, particularly large scale storage paired with renewables. In any event, the demand for renewable energy from both existing and new projects seems assured. As Duke Energy notes “The future is bright for continued renewable energy development in the Carolinas as both states have supportive policy frameworks and above average renewable resource availability, particularly for solar7.”

1. https://www.seia.org/states-map as noted on p38 of the Duke Energy Carolinas, LLC 2020 Integrated Resource Plan.

2. “Duke Energy Vows to Eliminate Its Carbon Emissions by 2050” Jeff St. John, Greentech Media September 18, 2019.

3. “Duke Energy Vows to Eliminate Its Carbon Emissions by 2050” Jeff St. John, Greentech Media September 18, 2019.

4. “Duke Sticks to Plan to Double Renewables Base Despite Questions Over Power Demand” Jeff St. John and Emma Foehringer Merchant, Greentech Media May 12, 2020.

5. “Gigawatts of solar and storage: Inside Duke Energy Progress’ renewables-heavy IRP” Liam Stoker, PVTECH September 3, 2020

6. “Math Doesn’t Yet Add Up” for Utility Decarbonization Goals: Deloitte” Jeff St. John, Greentech Media September 21, 2020.

7. Duke Energy Carolinas, LLC 2020 Integrated Resource Plan p38-39.